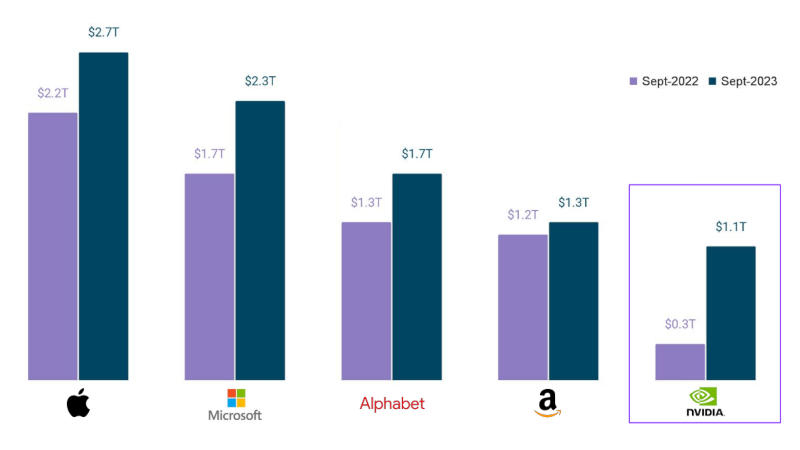

AI helps IT giants increase capitalization by $2.4 trillion in one year

The stock prices of major technology companies, including Apple, Microsoft, Alphabet, Amazon, and NVIDIA, have experienced an average annual growth of 36%, resulting in a collective gain of $2.4 trillion, as reported in the annual Euroscape report (PDF) presented by the venture capital firm Accel.

NVIDIA has notably surged ahead, joining the exclusive "trillion-dollar club" with a market capitalization now exceeding $1 trillion. The company's achievement can be attributed to its accelerators, widely employed in cutting-edge generative artificial intelligence models.

Since the beginning of the year, the index of companies offering cloud services and operating on the SaaS model, including Salesforce, Palantir, and Unity, has seen a remarkable 29% increase. This growth represents a significant recovery, considering that the previous year was challenging for this segment due to the loss of $1.6 trillion, primarily caused by investor withdrawals. The tech market is rebounding much faster than it did after the dot-com crash, with the Nasdaq Composite index already reclaiming 80% of its peak value over the past 18 months.

The primary driver behind the growth of cloud and SaaS services has been artificial intelligence technologies. OpenAI has been the most prominent, securing $10 billion in investments, with Inflection following at a distant second with $1.3 billion. In Europe, leading developers of generative AI include French companies like Hugging Face ($235 million), Poolside ($126 million), and Mistral AI ($113 million). While the number of "unicorns" (startups valued at over $1 billion) has returned to pre-pandemic levels, the share of AI developers has increased to 40% in Europe and Israel and a remarkable 80% in the United States.

However, this year has been challenging for the tech industry, marked by reduced fundraising and sharp declines in valuations. Market players are now paying more attention to growth and expansion rather than short-term profits. Additionally, rising interest rates have led to increased capital costs. As a result, the growth rates in the Euroscape list have dropped significantly, with the average decline from 68% in the first quarter of 2021 to 23% in the second quarter of 2023.

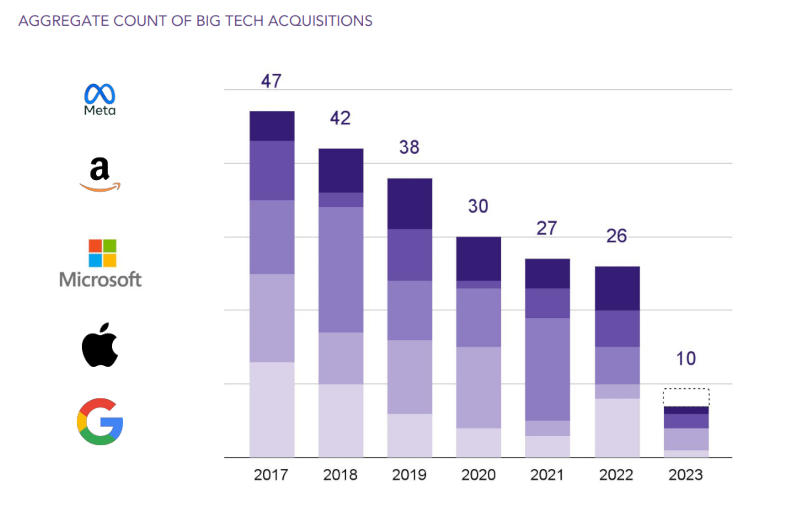

Lastly, there has been a sharp decrease in the number of acquisitions involving major technology companies. In 2021, there were 27 such deals, followed by 26 in 2022, and only 10 in the current year. A recent acquisition deal involving the largest gaming publisher, Activision Blizzard, was closed by Microsoft. This merger faced regulatory challenges globally, making it a complex process for the companies involved.

- Related News

- Which smartphones will be the first to receive Android 15?

- Android smartphone users can now send emojis during phone calls

- Compact, great cameras and low price: What do we know about the Google Pixel 8a?

- Alphabet will pay dividends for the first time in its history

- Google's Gemini app is already available for older versions of Android

- Google is developing a budget smartwatch

- Most read

month

week

day

- Digital Julfa Network is launching a pan-Armenian centre in the metaverse, on the Fastexverse virtual platform 867

- Sparkles: Boston Dynamics unveils a furry robot dog that can dance (video) 780

- Xiaomi unveils exclusive Redmi Note 13 Pro+ dedicated to Messi and Argentina national team 736

- Is there a ninth planet in the solar system? Scientists find new evidence 659

- Smartphone catches fire in child's hand in Russia 653

- What will happen to the Earth if the Moon disappears? 624

- How to understand how protected a smartphone is from water and dust? 623

- World's largest 3D printer was created in USL It prints 29 meter-long structures 617

- New iPad Pro to receive M4 chip and to be more powerful than Apple computers 598

- iPhone 16 may get colored matte glass back panel, 7 colors 594

- Archive