Following two-year decline, smartphone sales increase sharply: What are the leading brands?

Analytical company TrendForce has reported the recovery of global smartphone production in the fourth quarter of 2023, marking the end of an eight consecutive quarters sales decline. In the fourth quarter, 337 million smartphones were produced worldwide, exceeding the previous quarter's results by 12.3%. Despite this impressive growth, the overall production for the year 2023 declined by 2.1% compared to 2022, reaching 1.166 billion devices.

Experts predict a "bright future, free from inventory pressure" for smartphone manufacturers. However, the pace of market recovery remains uncertain. Artificial Intelligence (AI) applications are at the forefront, with all device manufacturers increasing efforts to release the next generation of AI-based smartphones. Production plans are being adjusted upwards in response to the year-end shopping season and market share consolidation.

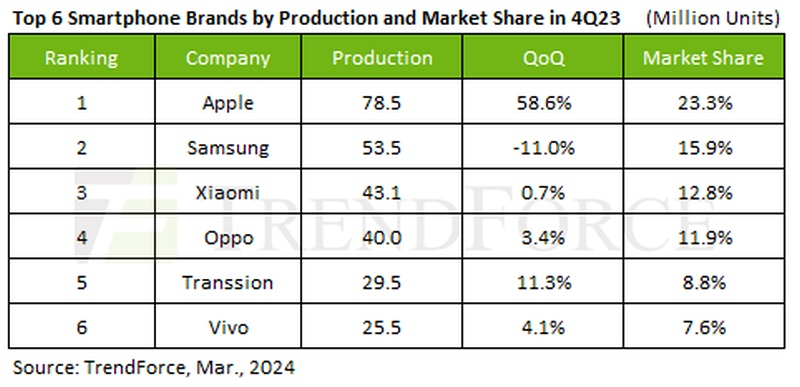

In the fourth quarter, Apple attracted attention with a 58.6% increase in production, driven by the excitement surrounding the iPhone 15 series, solidifying its leadership by releasing approximately 78.5 million smartphones. However, despite leading in that quarter, Apple secured only the second position for the year, due to a 4.2% decline in annual production to 223 million units. It is expected that with the revival of Huawei, Apple will face further competition in the premium market segment in China, where both brands vie for the same consumer base.

Samsung recorded a production decrease of 11% in the fourth quarter to approximately 53.5 million units, maintaining its second position for the quarter. The company managed to retain the overall top spot with 229 million smartphones shipped in 2023. However, annual production declined by 11.3%, and the lead over Apple narrowed to a minimal 0.5%.

Xiaomi (including Xiaomi, Redmi, and Poco) increased production by 0.7% in the fourth quarter, releasing 43.1 million smartphones and maintaining the third position in both quarterly and annual rankings, despite a 6.1% annual decrease to 147 million units.

Oppo (including Oppo, Realme, and OnePlus) demonstrated a quarterly growth of 3.4%, with a year-end production decrease of 4.1% to 139 million units. This secured the company the fourth position in both the annual and quarterly rankings.

Vivo (including Vivo and iQoo) produced 4.1% more smartphones in the fourth quarter, but showed a 2.9% decrease for the year, reaching 93.5 million units. The company retained the fifth position in the annual ranking but dropped to the sixth position in the fourth-quarter results.

Transsion (brands Tecno, Infinix, and Itel) not only achieved a confident 11.3% growth in the fourth quarter with 29.5 million smartphones shipped but also made history by surpassing the annual production barrier of 90 million devices, showing a 46.3% growth compared to the previous year. In the fourth quarter results, Transsion secured the fifth position in the global ranking.

- Related News

- 8800 mAh battery, 2.4K IPS screen, thermal imager: Blackview has introduced a new ultra-durable smartphone

- Insider shows mockups of all 4 iPhone 16 models

- Apple sees its worst iPhone sales in US in 6 years

- What risks are hidden in keyboards of Android smartphones?

- iPhone sales in China drop by about 20%: What is the reason?

- Powerful battery, Snapdragon 7 Gen 3, IP54, 120 Hz: Oppo introduces it’s new Oppo K12 smartphone, priced at $260

- Most read

month

week

day

- Huge battery, IP68/IP69K and MIL-STD-810H certifications: Ulefone will present the Armor Pad 3 Pro tablet (photo) 912

- How will new technologies change future of finance? Interview with director of Apricot Capital (video) 726

- 5 original buildings with curious optical illusions (photos) 721

- 10 most interesting architectural works of Zaha Hadid 701

- What risks do crypto and digital currencies pose? Interview with Rasmus Nielsen 689

- WhatsApp will get new and useful feature 621

- 4 flares erupted from Sun in rare event: the Earth may be hit by geomagnetic storm (video) 619

- Mutated bacteria resistant to drugs found on the ISS: What does this mean and why is it a problem? 605

- Android 15 to get two useful new features 597

- Date of new Apple presentation known: When will they show us new iPad Pro with OLED screen? 594

- Archive