Alphabet ad business in decline, company records worst performance in 4th quarter

Alphabet—Google's parent company—has released its fourth quarter earnings and revenue report. It turns out that the indicators are significantly lower than the experts expected. After the coronavirus pandemic, advertisers at Alphabet have significantly reduced the cost of promoting their business.

As reported by Reuters, in a report presented to investors, Alphabet promises to start a new period of "belt-tightening," in particular, to reduce spending on real estate and the development of experimental projects that may take years to bear fruit. The company's shares fell 5% amid the news of the report. Moreover, the company's shares had already lost about 40% of their value in 2022.

During the fourth quarter, the company's net profit fell to $13.62 billion, compared to $20.64 billion last year. This is Alphabet's worst performance in four quarters.

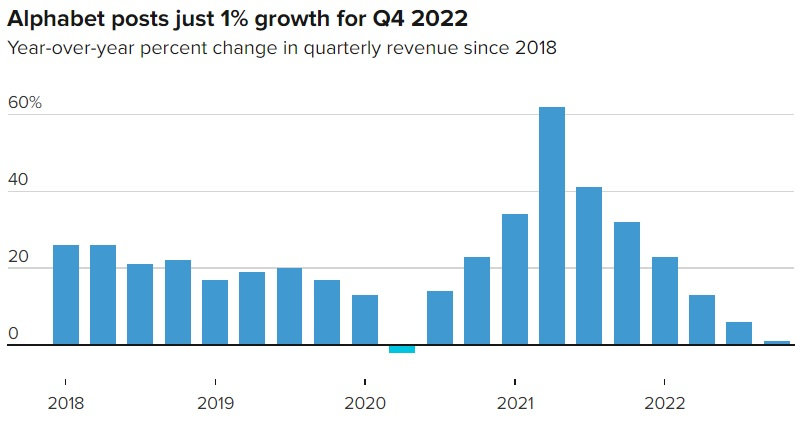

Google's ad revenue—including search and YouTube—fell 3.6% to $59.04 billion, while total revenue rose 1% to $76.05 billion. Such slow growth is observed for the first time in recent years, except for the second quarter of 2020 when a slight decline was recorded. Industry experts expected the revenue to be $76.52 billion.

In terms of market share, Google is the largest digital advertising platform, which makes it extremely vulnerable to market fluctuations. In addition, YouTube is already under serious pressure from TikTok, which attracts a younger audience and whose business continues to grow.

YouTube’s ad revenue, one of Alphabet's biggest sources of revenue, fell about 8% to $7.96 billion, below expectations of $8.25 billion. In the reporting period, the cloud business recorded a good result, the revenue of which increased by 32% to $7.32 billion.

According to Alphabet chief financial officer Ruth Porat, in 2023 the company will focus on revenue growth and significant changes in cost structure. Capital expenditure this year will be at the same level as last year, as more employees work remotely and the company optimizes its workforce. Alphabet expects to reduce real estate costs, which should be about $500 million in the first three months of the year alone.

The CEO of the company, Sundar Pichai, for his part, said that Alphabet approaches investments responsibly and chooses domains where it can operate most efficiently financially. According to Pichai, the introduction of artificial intelligence systems will become a priority for the company. The latter plans to introduce the LaMDA chatbot to the public in the coming weeks.

It is noteworthy that yesterday Mark Zuckerberg, the head of Alphabet's competitor Meta, announced the start of a "year of efficiency." The reason for some of the decline in many IT companies now is that the period of "abundance" during the coronavirus pandemic, when people stuck at home during lockdowns spent more time on the internet thanks to which companies spend more money on advertising, is over.

Advertisers also continue to reduce their spending on Alphabet's services, as they assume that inflation and high interest rates on loans will mean that potential buyers may spend less on their products and services. The fall in the exchange rates of many currencies against the US dollar also played its role in this matter.

Alphabet last month decided to cut 12,000 jobs, about 6% of all employees, and plans to slow the pace of hiring this year.

- Related News

- What are the best selling smartphones in the world?

- Key Google Pixel feature will soon be available on iPhone as well

- Instead of writing, dictate the email in Gmail. Google Workspace will get a number of AI tools

- Fraudsters have started using Google's popular service to steal users' money

- Famous blogger earns $1 million by publishing only 5 old videos on X

- Google will launch service to find lost devices even if they are not connected to Internet

- Most read

month

week

day

- iPhone users are advised to disable iMessage: What risks are hidden in it? 1380

- New Macs based M4 chip will get up to 512 GB of integrated memory, M4 is expected to be released in late 2024 1122

- Problems with Android 15: NFC contactless payments no longer work on smartphones with updated operating systems 1061

- Pavel Durov gives interview to Tucker Carlson: From 3-hour interview, less than hour appears in final version 931

- What are the best selling smartphones in the world? 858

- Key Google Pixel feature will soon be available on iPhone as well 748

- Wildberries Travel service is already available for Armenia and other CIS countries 730

- AMD Ryzen 7 processor, 24 GB of RAM and only $550: Mechrevo presents inexpensive and powerful laptop (photo) 727

- The 5 most controversial buildings ever built: Bold design or complete failure? (photo) 722

- Black Shark smart ring from Xiaomi to have interesting characteristics and phenomenal autonomy: 180 days of operation without recharging (photo) 691

- Archive